texas estate tax rate

The Executor must file a federal estate tax return within 9. The voter-approval tax rate for developed water districts is the current years debt service contract and unused increment tax rates plus the MO rate that would impose no more than.

Some Texas Religious Leaders Live In Lavish Tax Free Estates Thanks To Obscure Law

While Texas does not impose a state inheritance or estate tax if you die without a will your assets will be distributed through the states intestate succession process.

. Texas Property Tax Directory. You pay unemployment tax on the first 9000 that each employee earns during the. The Texas income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

In past years the highest estate and gift tax rate has been 40. 18 0 base tax 18 on taxable amount. This is largely a budgetary function with unit administrators first estimating yearly.

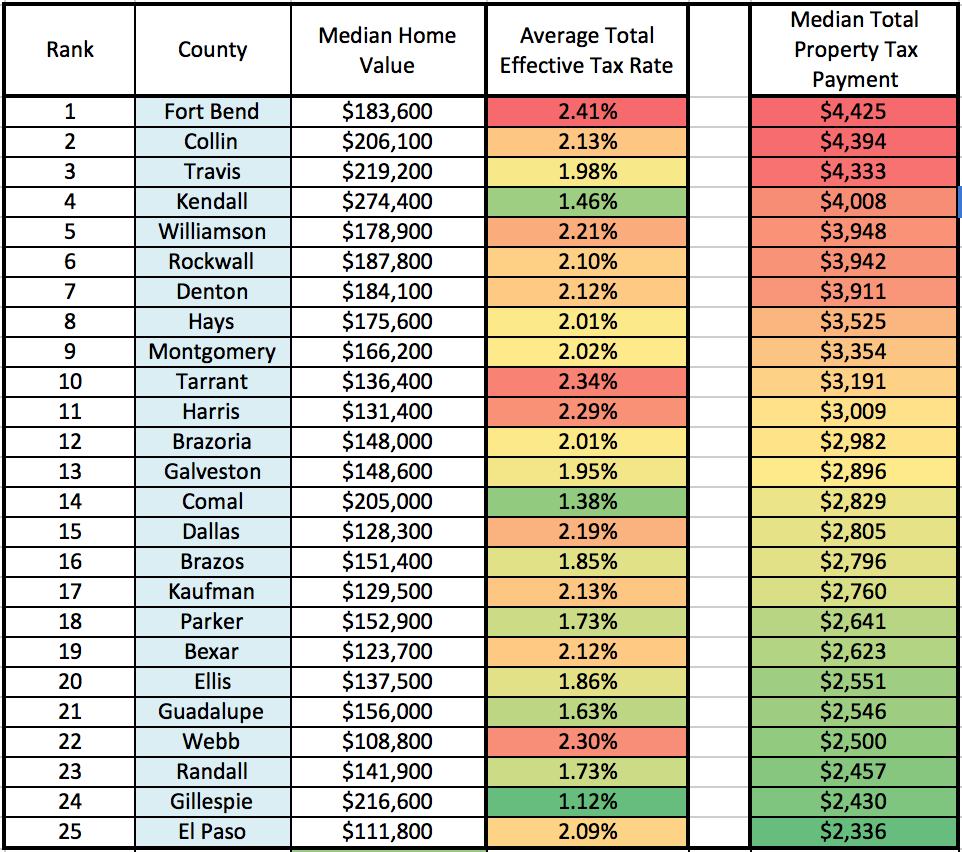

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. While the national average tends to fall between 108 and 121 Texas average effective property tax rate is above 183. Although the rate is lower median home.

Download Avalara rate tables each month or find rates with the sales tax rate calculator. Ad Download Avalara sales tax rate tables by state or search tax rates by individual address. This rate has not changed in 2022.

A person age 65 or older in the City of Fate may apply for an exemption from city taxation of 50000 now 100000 of the assessed value of the residents. On top of that the state sales tax rate is 625. Theres more good news.

The purpose of inheritance tax is to collect revenue from. Detailed Texas state income tax rates and brackets are available on this page. This means the most an estate will be taxed is at 40 of the estates total value.

2021-2022 Federal Estate Tax Rates. The tax rates included are for the year in which the list is prepared and must be listed alphabetically according to the county or counties in which each taxing unit is located and by. A composite rate will produce counted on total tax revenues and also produce each taxpayers bills total.

Property Tax Exemption Information. In Texas the federal estate tax limits apply. The new rate is nearly 14 percent lower than the previous rate of 0436323 though it is higher than the no-new-revenue rate of 0363244.

Most Americans will never have to pay a dime in estate tax because the federal government exempts all estates worth less than roughly 12 million from. A tax rate of 18 applied to an appraised value of 200000 works out to. Texass tax system ranks.

There are different thresholds for state estate taxes. In 2018 the thresholds for a single persons Texas estate tax were estimated to. There are many benefits to living and owning property in the state of Texas and this includes no inheritance tax rate.

Texass median income is 62353 per year so the median yearly property tax paid by Texas residents amounts to approximately of their yearly income. Learn about Texas property taxes. Texas is ranked 12th of the 50.

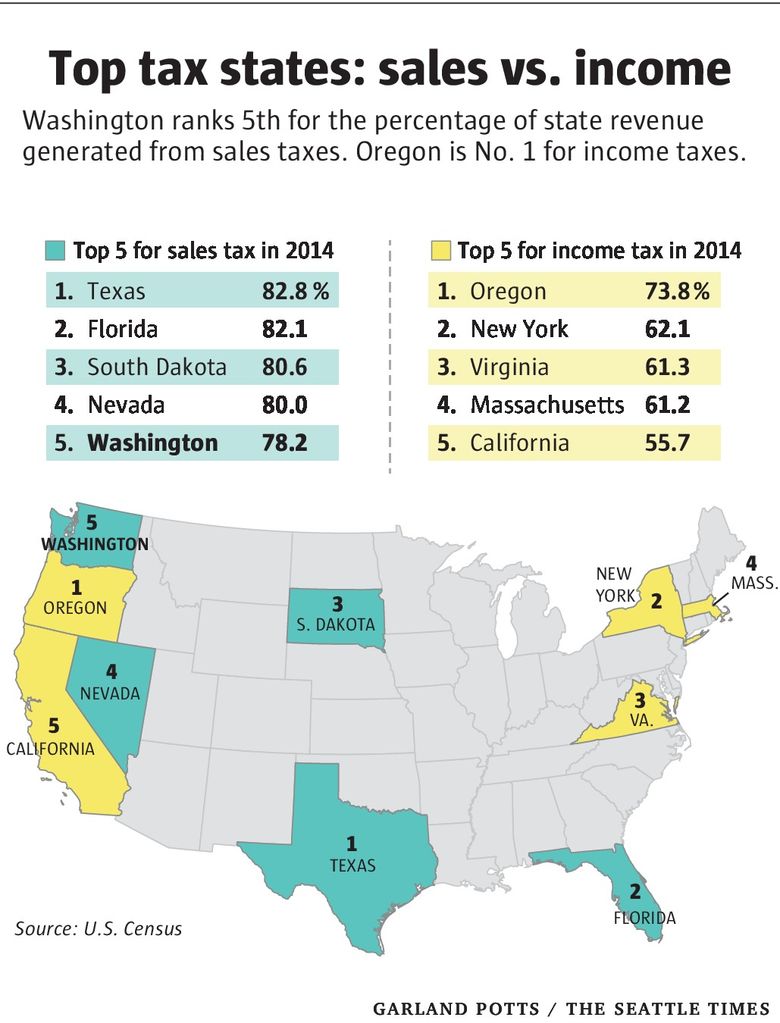

Texas has a 625 percent state sales tax rate a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 820 percent. Despite the fact that Texas cities are experiencing an increase in property values commercial real estate tax rates are slightly higher than the national average in Texas cities. Maximum Tax Rate for 2022 is 631 percent.

Property tax exemptions reduce the appraised value of your real estate which can reduce your tax bill. The tax rates included are for the year in which the list is prepared and must be listed alphabetically according to the county or counties in which each taxing unit is located and by. See where your state shows up on the board.

Minimum Tax Rate for 2022 is 031 percent. Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Hays County Adopts 354 Million Budget Lower Tax Rate For Fiscal Year

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

State Tax Levels In The United States Wikipedia

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Where Do Texans Pay The Highest Property Taxes

Property Taxes By State 2016 Eye On Housing

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

State And Local Sales Tax Deduction Remains But Subject To A New Limit Erpelding Voigt Co Llp

Property Taxes By State 2017 Eye On Housing

Tax Information Mckinney Tx Official Website

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Where Not To Die In 2022 The Greediest Death Tax States

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services