is interest on your car loan tax deductible

Can you deduct car loan interest when filing taxes. You must report your tax-deductible interest to the IRS and this invariably.

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Is car loan interest tax deductible.

.jpg)

. This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction. The faster you pay off your car title loan the less you will pay in interest. Typically if you take out a car loan to buy a vehicle that will be used for business purposes you could claim some of the expenses on your tax.

In addition interest paid on a loan thats used to purchase a car solely for persona. The interest on a car title loan is not generally tax deductible. Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. It is fairly clear that the interest paid on home loan is allowed as a deduction in all cases. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes.

Tax benefits on Car Loans. This is because the only interest that is still deductible as an itemized deduction is home mortgage interest and investment interest. However there are also requirements and limitations.

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. In short the answer is no. It is only allowed to be treated as an expense where the Car is being used for Business purposes.

In this case neither the business portion nor the personal portion of the interest will be deductible. Its good form to keep track of all business use for your car so you can accurately report it. You might pay at least one type of interest thats tax-deductible.

The expense method or the standard mileage deduction when you file your taxes. Can I deduct my car loan interest. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

But you cant just subtract this interest from your earnings and pay tax on the remaining amount. The standard deduction for the 2022 tax year was 12950. You cannot deduct a personal car loan or its interest.

Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income. However for commercial car vehicle and equipment loans the interest i s a tax deduction. Tax-deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

Claiming your home equity loan interest could prove to be a bit difficult particularly for. But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file. Personal credit card interest auto loan interest and other types of personal consumer finance interest are not tax deductible.

It can also be a vehicle you use for both personal and business purposes but you need to account for the usage. Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently. February 27 2022 438 PM.

Do you get to claim interest for a car loan. However the interest paid on car loan is not allowed as an expense in all cases. While typically deducting car loan interest is not allowed there is one exception to this rule.

But there is one exception to this rule. Therefore the quick and easy answer to the question is no However some other loan-related expenses are deductible so dont stop at auto loans when searching for deductions. You can claim it even if you itemize your deductions and it may help you qualify for other tax deductions or credits.

Up until 1986 it was possible for auto loan interest to be tax deductible. However if you are buying a car for commercial use you can show the interest paid. If a Salaried person takes a Car Loan then he cannot claim the Interest on Car Loan as an expense.

You just cant claim both the standard and home equity deductions. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. Some of the expenses you may get a tax rebate for include operational expenses like fuel and oil repairs and servicing lease payments insurance premiums registration and depreciation.

What this means is you must be self-employed own a small business or use a vehicle for work. If you can get your itemized deductions above that figure you can claim the interest from your home equity loan on your taxes. However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a much better benefit.

During Ronald Reagans time in office he reformed tax laws so that auto loan interest can no longer be tax deductible. The student loan interest deduction is particularly valuable as its an above-the-line deduction technically making it an adjustment rather than a deduction. No you cannot claim interest for a car loan.

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. Most employees cannot deduct car loan interest unless the amount is related to business use. If you use your car for business purposes you may be able to deduct actual vehicle expenses.

If you use your car for business purposes you may be able to deduct actual vehicle expenses. When you can deduct car loan interest from your taxes Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest. You can deduct the interest paid on an auto loan as a business expense using one of two methods.

But you can deduct these costs from your income tax if its a business car. If the vehicle is entirely for personal use. None of the interest will be deductible.

Typically deducting car loan interest is not allowed. If you have a vehicle thats used partly for business and partly for personal use the interest is deducted as the percentage that the car is used in your business. Since you are self-employed if its used for business and you take actual expenses a prorata portion will be deductible based on business miles to total miles just like other expenses for the vehicle.

If you are an employee of someone elses business you are not eligible to claim this deduction. The answer to is car loan interest tax deductible is normally no. Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. If you have a car loan for the vehicle you may also be able to deduct the interest when filing your federal tax returns. This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction.

Should You Pay Back Your Car Loan Early

Can You Pay Off A Car Loan Early To Avoid Interest Car Loans Finance Guide Car Payment

The Best Ways To Spend Your Tax Refund Visual Ly Tax Refund Tax Return Tax Help

10 Things You Should Never Deduct From Your Taxes All Time Lists Best Car Insurance Car Insurance Online Cheap Car Insurance

Avail Auto Loan Via Yono Sbi Car Loans Dream Cars Loan

Explore Our Image Of Car Payment Schedule Template For Free Car Payment Calculator Car Payment Car Loans

Vehicle Loan Car Two Wheeler Loan Online Bank Of Baroda

Pin On Cash For Cars South Auckland

How To Secure A Low Rate Car Loan Car Loans Car Finance Financial Tips

7 Tips To Sell Your Car Online Car Rental Service Car Rental Things To Sell

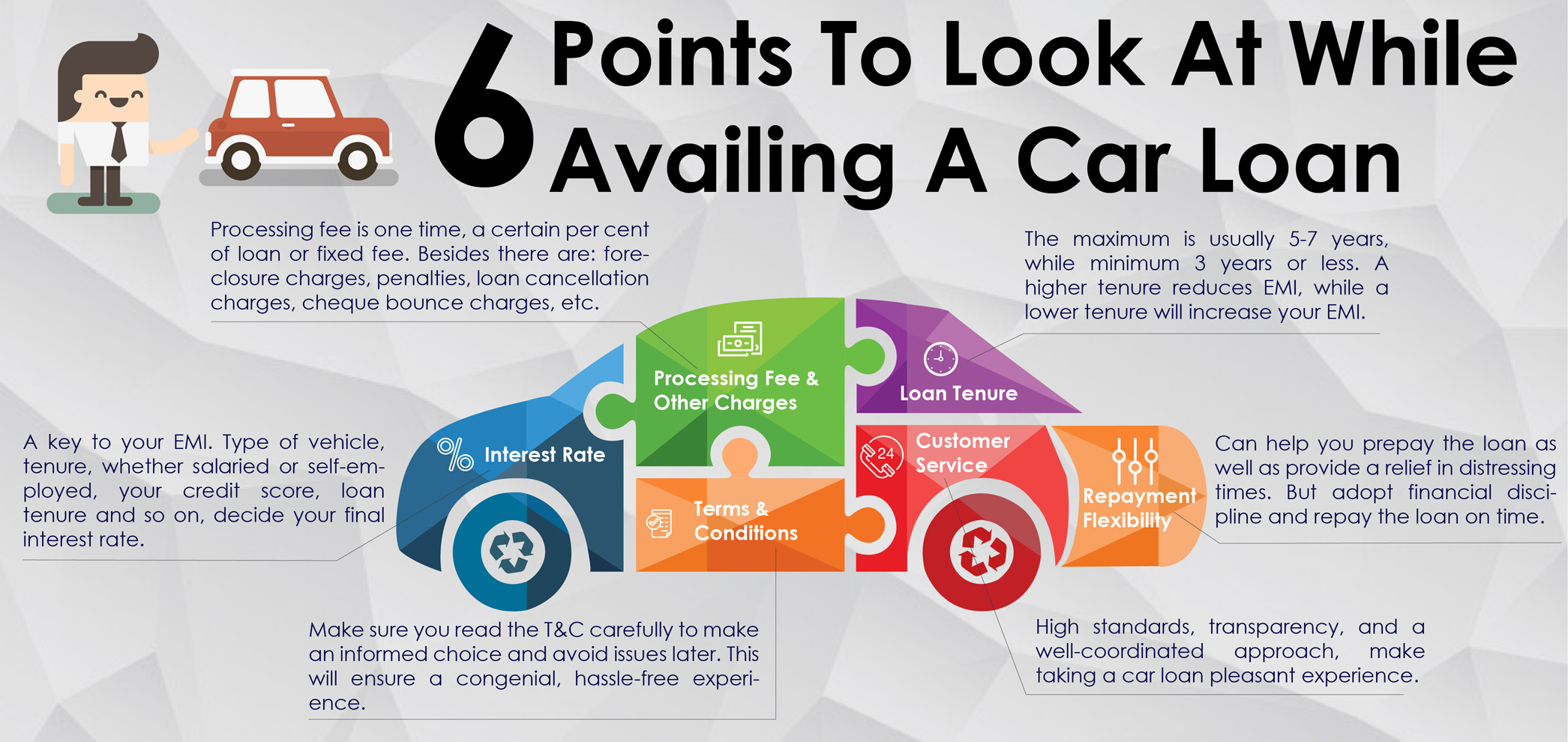

6 Points To Look At While Buying A Car For Your Family This Festive Season Axis Bank

.jpg)

How A Self Employed Can Apply For A Car Loan Axis Bank

Used Car Loan Car Loans Used Cars Loan

Buy Your Own House In 2020 Investing Tax Deductions Home Loans

Deduction Under Section 80 Eeb Of Income Tax Act Online Taxes File Taxes Online Income Tax

Car Loan Tax Benefits And How To Claim It Icici Bank

Yes Bank Car Loan At 7 00 Interest Rate Dialabank 2022

2022 Car Donation Tax Deduction Information Donation Tax Deduction Tax Deductions Donate Car